Your Personal Social Security BenefitsYour first step to determine your personal sweet spots is to find out what your personal benefits will be. Contact the Social Security Administration or create a log on to My Social Security and find out your PIA, your monthly Primary Insurance Amount that you will receive if you start your benefits at your NRA, Normal Retirement Age. The next step is to go to the Social Security website’s Early Late page, enter your birth date and the month and year when you plan to start your benefits. Click the Compute button and the page will tell you the percentage of your PIA that you will receive each month (COLA adjusted) for the rest of your life.

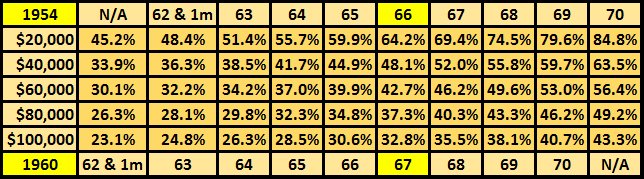

The table to the left gives you an idea of what your monthly PIA could be based on the average of the top 35 years of your inflation adjusted income on which you paid Social Security tax. It also gives you your yearly benefit level which is what is used throughout this wesite. Note how your rate of return decreases as your average income increases. The right hand table shows how your PIA will be increased or reduced if you decide to retire early or late. Your NRA will be 66 if you were born in or before 1954, and 67 if you were born in or after 1960. We should also look at this table from the viewpoint of the percentage of our working income that we will receive from Social Security.  There is a lot of talk about means-testing our Social Security benefits. This table illustrates how our benefits are basically already means-tested. The larger your working income the smaller the percentage of that income that you will receive as your Social Security benefit.  Now that we have a reasonable idea of what your personal Social Security Benefit level might be based on the age you choose to start your benefits, let's look at the concept of Break Even from your investment banker's viewpoint, and what your viewpoint of Break Even should be! Next - How your personal Break Even should be calculated! |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||